Frequently Asked Questions (FAQ)

Who determined what projects would be on the list?

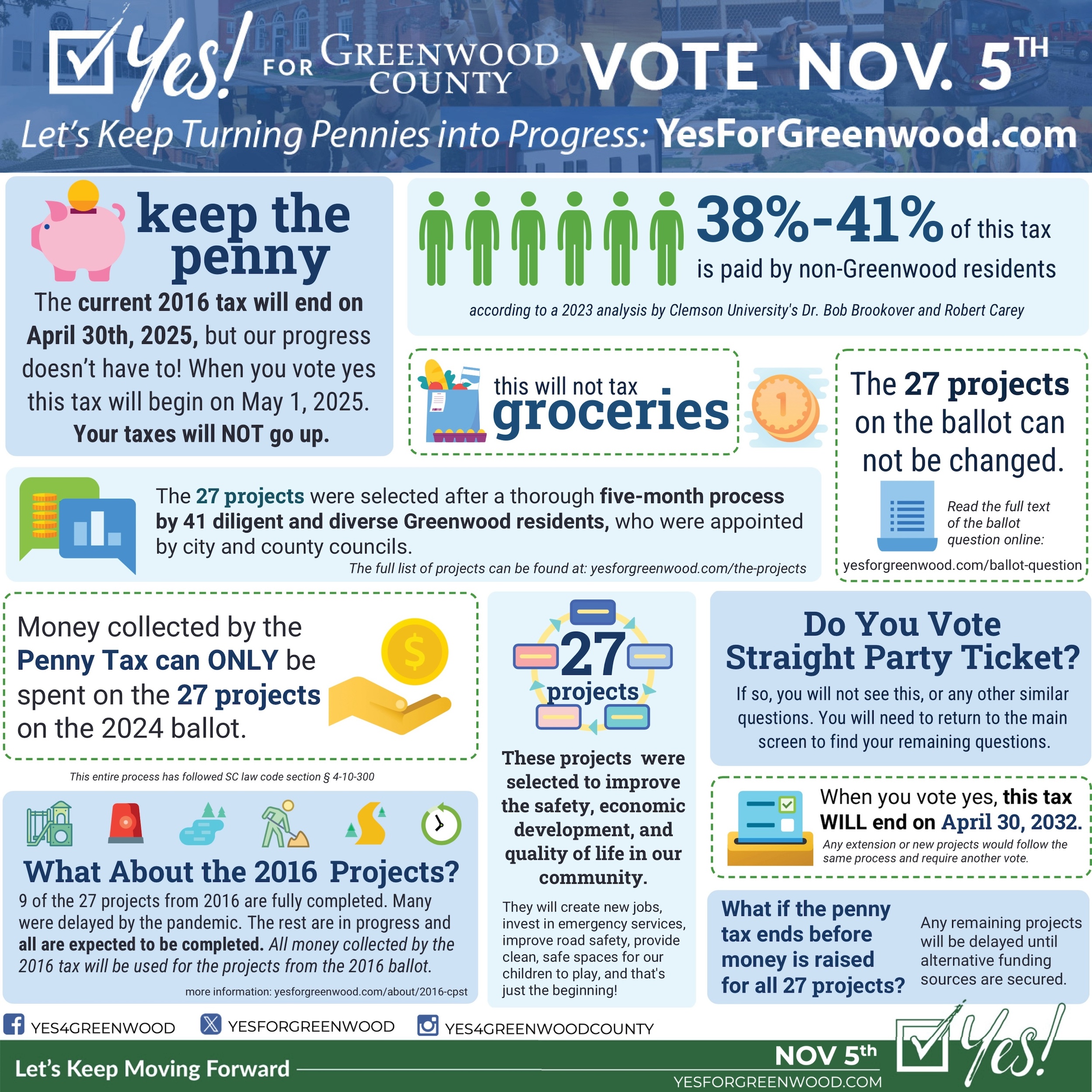

Five Committees were assembled, each made up of five Greenwood citizens with varying backgrounds. Greenwood County advertised for and accepted applications from any organization or individual that wanted to submit a project for consideration. 40 applications were received. The Committees recommended 27 projects to the six member 2024 Greenwood County Capital Project Sales Tax Commission appointed by City and County Councils as required by SC state law. The Commission agreed with the committee’s recommended 27 projects. The commission recommended the referendum question to Greenwood County Council. Greenwood County Council unanimously approved the referendum question, as presented, to be placed on the November 5, 2024 ballot for Greenwood County voters to consider.

Curious how the projects were chosen?

Review the County meetings and documents to learn more about the process:

Do we really need these projects?

All of the 27 projects are necessary to improve the safety, economic development and quality of life of our community. “Need” is a subjective term, but there is no doubt that our community needs new jobs, investment for police and fire protection, safer roads and safe, clean places for our children to play.

Can the list be changed or be amended before election day?

No, once Greenwood County Council gave the final reading to the list on July 18, 2024, changes to the project list are not allowed.

If I vote yes, Who will pay for all of this?

In 2023, Greenwood County commissioned Clemson’s University Dr. Bob Brookover and Robert Carey to determine the percentage of this sales tax that is paid by non Greenwood County residents. Their analysis said 38% – 41% of this tax is paid by people who live outside of Greenwood County, but travel through or work in Greenwood County. The remainder is paid by residents of Greenwood County.

If I vote yes, will the 1% sales tax apply to groceries?

Unprepared food items eligible for purchase with United States Department of Agriculture food coupons are exempt from the capital projects sales tax. This includes food items that are eligible for purchase with SNAP, WIC, or EBT Benefits.

Exemptions are applied automatically and you do not need to receive SNAP, WIC, or EBT Benefits for the exemption to apply.

Also, prescription medication is exempt from the Capital Project Sales Tax.

If I vote yes, will the additional sales tax go on forever?

No. County Ordinance states “The maximum time for which the tax may be imposed shall be eight (8) years from the date of imposition.” If passed, the imposition date would be May 1, 2025. Therefore, the MAXIMUM date would be May 1, 2033. Any extension beyond this point would have to follow the same process and would require another referendum vote by Greenwood County voters.

If I vote yes, can Greenwood County change the projects?

No, State law does not allow any changes to the projects.

If I vote yes, Can the money collected for these projects be used on other things?

No. The list is an all or nothing vote. Under State law, the money generated must be spent on the projects listed on the ballot.

What happens if the sales tax doesn’t generate enough money?

Much effort was given to monetizing the projects to include adding a cost inflation factor. All projects are expected to be complete. However, if the 1% sales tax will not fund all of the projects, the projects at the bottom of the list will not be started unless the City Council or County Council find alternative sources to fund those projects completely.

If I vote yes, would the proposed 1% Capital Project Sales Tax apply to Internet purchases?

Yes, according to the South Carolina Department of Revenue. The Capital Projects Sales Tax will be collected on an Internet sale if the purchase is delivered to an address in Greenwood County.

Can I vote for this Capital Project Sales Tax through a straight Democratic or Republican ticket?

Please note if you vote a straight ticket on the ballot, you will not be directed immediately to the additional questions. You will need to return to the main screen to find the remaining questions to vote for the Capital Project Sales Tax.

Is the CPST a new tax?

No, this is not a new tax. This will be a simple continuation of the 2016 penny that has already been approved.

How much money has been spent and collected from the 2016 CPST?

As of July 2024, a little over $77 million has been collected. Of this amount, about $45 million has been spent. 9 of the 27 projects are fully completed.